Bradesco

Evolving digital financial experiences for 19 million digital users

WHAT I DID

Design Leadership

Product Strategy

Hands-on Visual &

Interaction Design

Design Leadership

Product Strategy

Hands-on Visual &

Interaction Design

Design Leadership

Product Strategy

Hands-on Visual &

Interaction Design

Period

2023 - current

2023 - current

2023 - current

ABout the project

Bradesco is one of Latin America’s largest financial institutions, serving over 70 million customers. Between 2022 and 2025, I served as a Design Lead, balancing strategic leadership with high-fidelity execution in visual and interaction design.

Leading a multidisciplinary team of six designers within the Credit and Debit Cards tribes, I spearheaded the end-to-end transformation of core financial products. Our mission was to dismantle complex legacy constraints and deliver a unified, world-class experience across four distinct banking applications. Below, I highlight some of the projects we are most proud of:

Bradesco is one of Latin America’s largest financial institutions, serving over 70 million customers. Between 2022 and 2025, I served as a Design Lead, balancing strategic leadership with high-fidelity execution in visual and interaction design.

Leading a multidisciplinary team of six designers within the Credit and Debit Cards tribes, I spearheaded the end-to-end transformation of core financial products. Our mission was to dismantle complex legacy constraints and deliver a unified, world-class experience across four distinct banking applications. Below, I highlight some of the projects we are most proud of:

Bradesco is one of Latin America’s largest financial institutions, serving over 70 million customers. Between 2022 and 2025, I served as a Design Lead, balancing strategic leadership with high-fidelity execution in visual and interaction design.

Leading a multidisciplinary team of six designers within the Credit and Debit Cards tribes, I spearheaded the end-to-end transformation of core financial products. Our mission was to dismantle complex legacy constraints and deliver a unified, world-class experience across four distinct banking applications. Below, I highlight some of the projects we are most proud of:

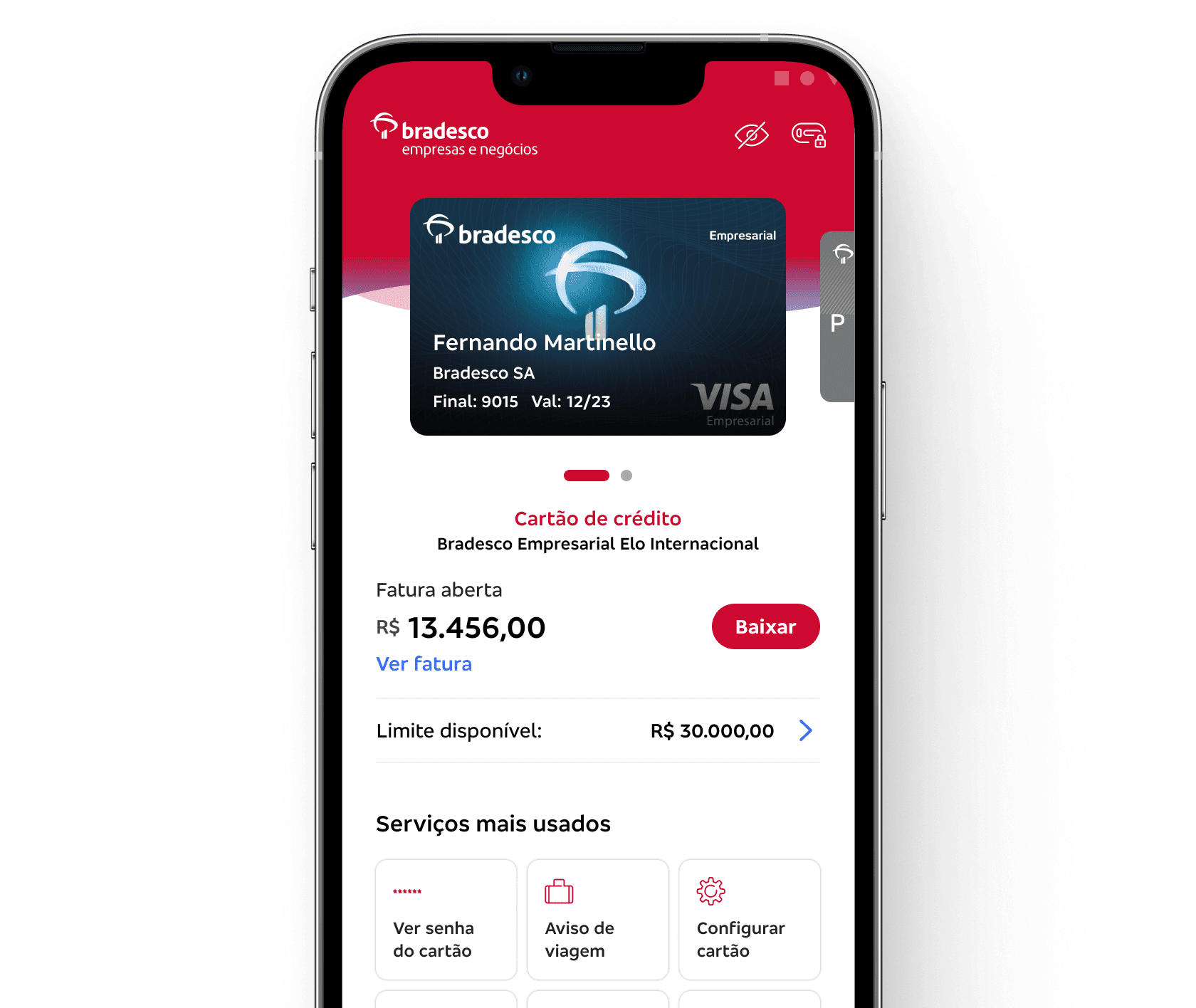

Unifying the card ecosystem

Unifying the card ecosystem

Unifying the card ecosystem

The primary challenge was to standardize the credit card experience across all of Bradesco’s digital touchpoints. With four different apps (for people and business) offering card management features, the goal was to create a cohesive and scalable interface that felt familiar to all 10 million users, regardless of which platform they accessed.

Strategic Focus: Consistency and scalability across 4 different banking apps.

A unified design language and shared architecture that reduced cognitive load for multi-app users and streamlined development for the engineering teams.

The primary challenge was to standardize the credit card experience across all of Bradesco’s digital touchpoints. With four different apps (for people and business) offering card management features, the goal was to create a cohesive and scalable interface that felt familiar to all 10 million users, regardless of which platform they accessed.

Strategic Focus: Consistency and scalability across 4 different banking apps.

A unified design language and shared architecture that reduced cognitive load for multi-app users and streamlined development for the engineering teams.

The primary challenge was to standardize the credit card experience across all of Bradesco’s digital touchpoints. With four different apps (for people and business) offering card management features, the goal was to create a cohesive and scalable interface that felt familiar to all 10 million users, regardless of which platform they accessed.

Strategic Focus: Consistency and scalability across 4 different banking apps.

A unified design language and shared architecture that reduced cognitive load for multi-app users and streamlined development for the engineering teams.

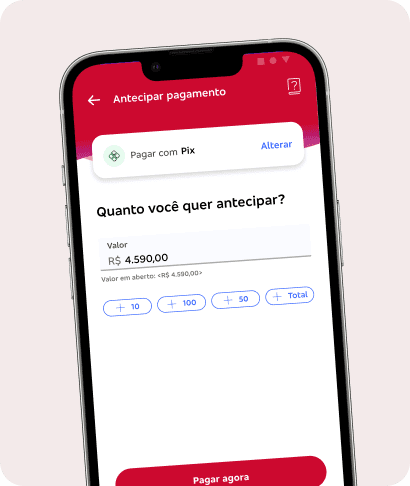

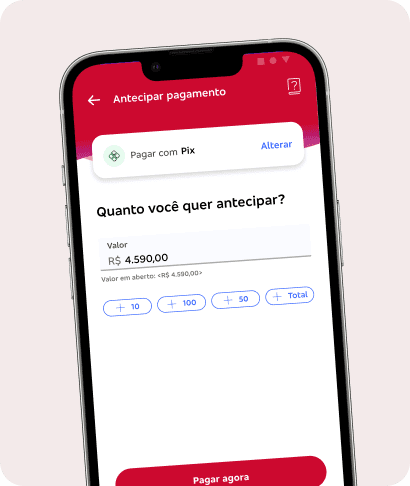

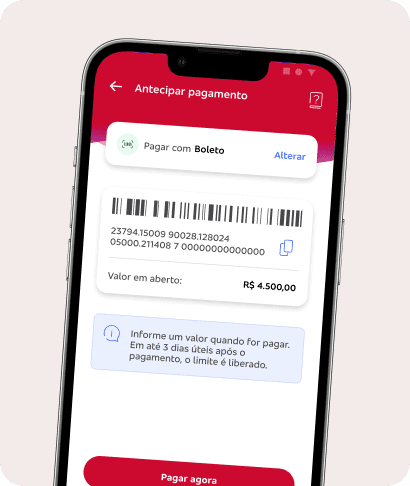

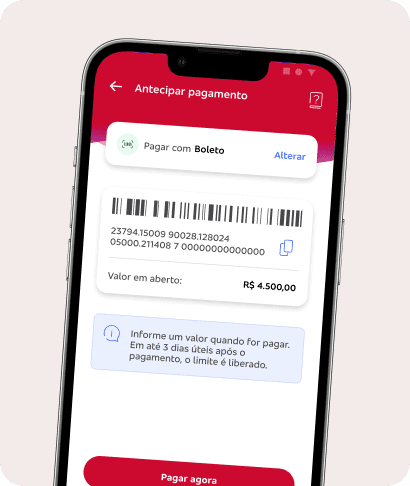

Modernizing legacy payments

Modernizing legacy payments

Modernizing legacy payments

We completely revitalized the bill payment journey, which was previously tied to rigid legacy systems. By re-engineering the flow, we introduced a seamless dual-payment experience—integrating Pix for instant credit limit restoration and traditional Boletos.

The Transformation: We turned a high-friction, backend-heavy process into a fluid, user-centric interface that prioritizes speed and financial control.

We completely revitalized the bill payment journey, which was previously tied to rigid legacy systems. By re-engineering the flow, we introduced a seamless dual-payment experience—integrating Pix for instant credit limit restoration and traditional Boletos.

The Transformation: We turned a high-friction, backend-heavy process into a fluid, user-centric interface that prioritizes speed and financial control.

We completely revitalized the bill payment journey, which was previously tied to rigid legacy systems. By re-engineering the flow, we introduced a seamless dual-payment experience—integrating Pix for instant credit limit restoration and traditional Boletos.

The Transformation: We turned a high-friction, backend-heavy process into a fluid, user-centric interface that prioritizes speed and financial control.

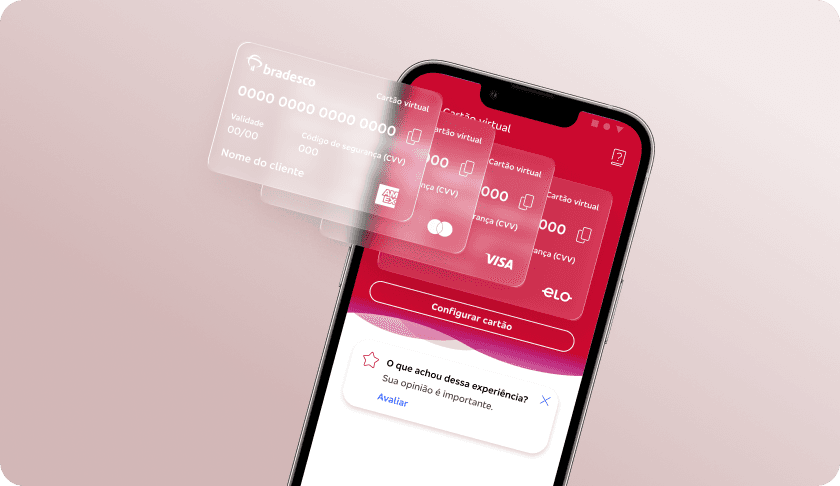

Evolving digital security with virtual cards

Evolving digital security with virtual cards

Evolving digital security with virtual cards

Moving beyond technical debt, we transformed the virtual card from a basic security feature into a premium digital tool. We redesigned the entire experience to offer a high-fidelity, intuitive management system that handles complex security protocols behind a sleek, minimalist UI.

The Transformation: A complete overhaul of legacy interaction patterns, focusing on one-click usability and dynamic data protection.

Moving beyond technical debt, we transformed the virtual card from a basic security feature into a premium digital tool. We redesigned the entire experience to offer a high-fidelity, intuitive management system that handles complex security protocols behind a sleek, minimalist UI.

The Transformation: A complete overhaul of legacy interaction patterns, focusing on one-click usability and dynamic data protection.

Moving beyond technical debt, we transformed the virtual card from a basic security feature into a premium digital tool. We redesigned the entire experience to offer a high-fidelity, intuitive management system that handles complex security protocols behind a sleek, minimalist UI.

The Transformation: A complete overhaul of legacy interaction patterns, focusing on one-click usability and dynamic data protection.

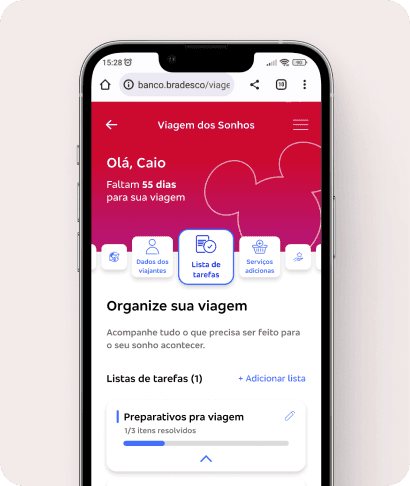

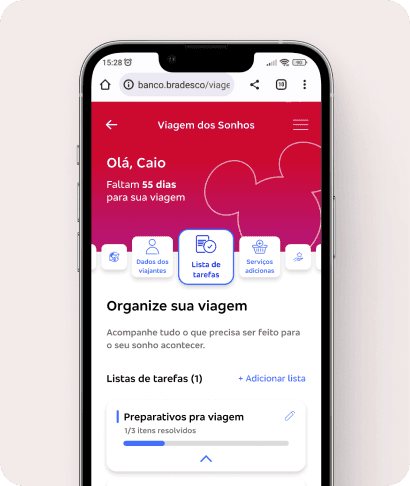

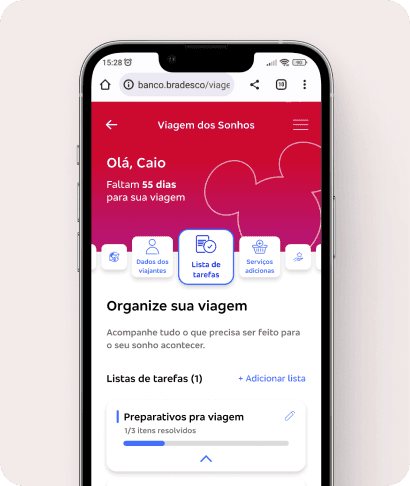

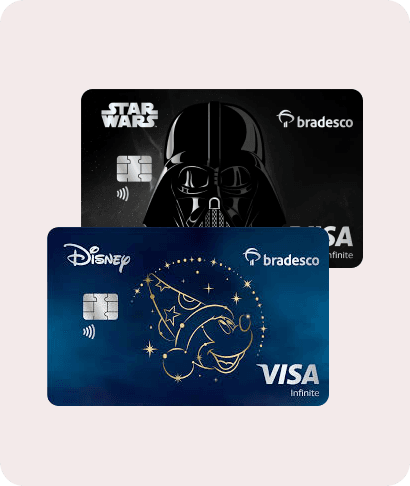

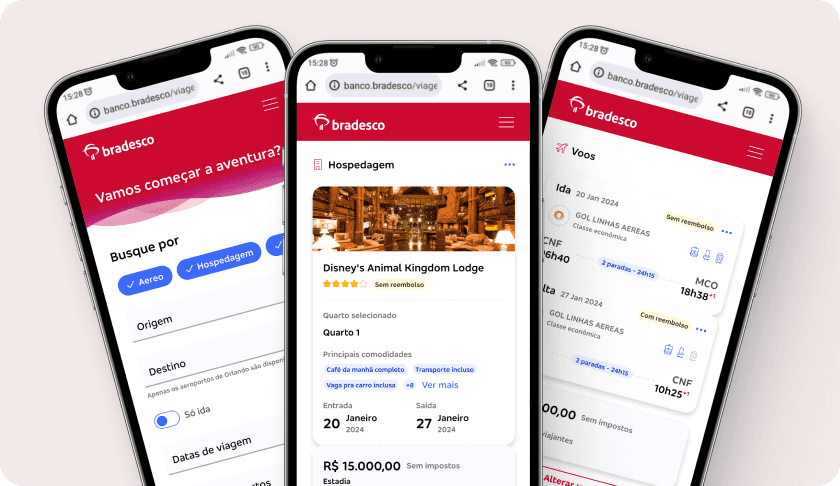

Democratizing the Dream

Democratizing the Dream

Democratizing the Dream

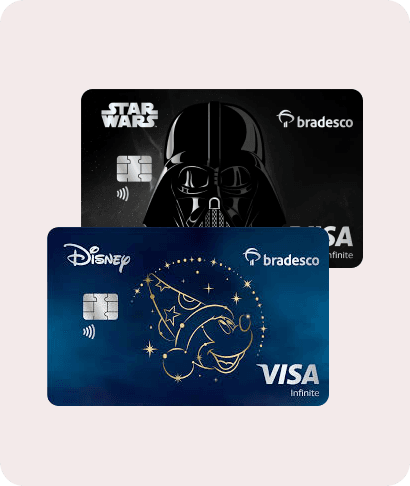

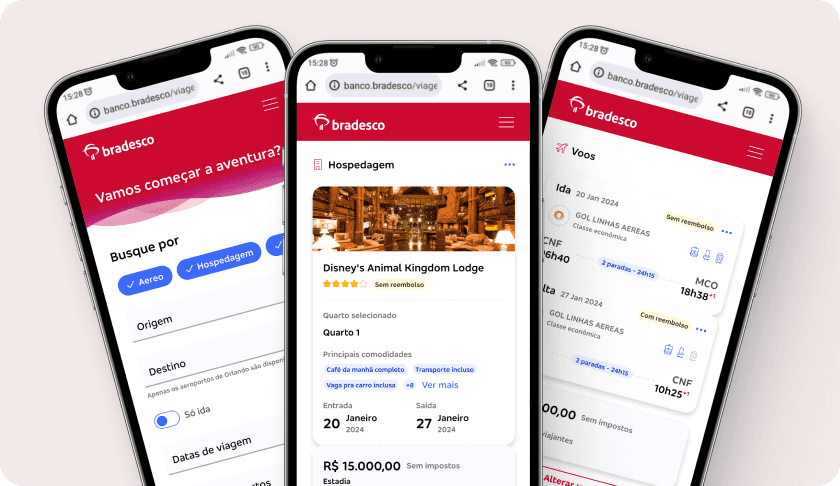

This project was designed to make the iconic Disney experience accessible to more Brazilians. By combining financial planning with lifestyle rewards, we created a product that empowers users to realize their dreams through flexible payment options and exclusive benefits.

Exclusive Value: The journey includes a dedicated Disney-themed card with unique perks, bridging the gap between banking utility and emotional aspiration through a gamified, supportive experience.

This project was designed to make the iconic Disney experience accessible to more Brazilians. By combining financial planning with lifestyle rewards, we created a product that empowers users to realize their dreams through flexible payment options and exclusive benefits.

Exclusive Value: The journey includes a dedicated Disney-themed card with unique perks, bridging the gap between banking utility and emotional aspiration through a gamified, supportive experience.

This project was designed to make the iconic Disney experience accessible to more Brazilians. By combining financial planning with lifestyle rewards, we created a product that empowers users to realize their dreams through flexible payment options and exclusive benefits.

Exclusive Value: The journey includes a dedicated Disney-themed card with unique perks, bridging the gap between banking utility and emotional aspiration through a gamified, supportive experience.